nassau county property tax rate

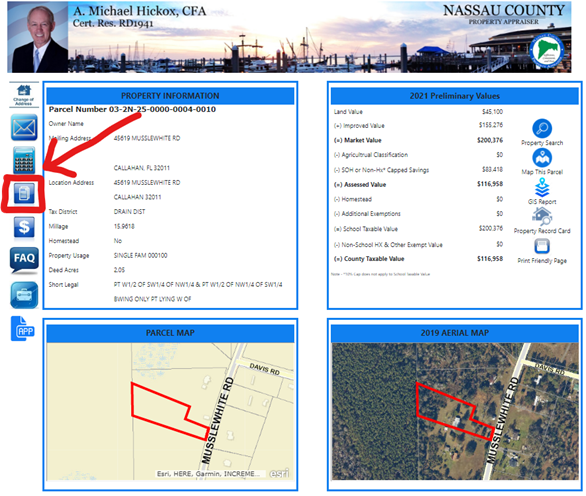

Web The Property Appraisers office determines the assessed value and exemptions on the tax roll. Part of its innovative design is protected by intellectual property IP laws.

Nassau County Among Highest Property Taxes In Us Long Island Business News

Web In Florida State the first half of 50000 of your property assessed value is applied if the property is your permanent residence and if you own the property on January 1 of the tax year.

. Real property market value is based on the current real estate market. Douglas County collects the highest property tax in Colorado levying an average of 076 of median home value yearly in property taxes while Costilla. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The average effective tax rate in Pinellas County is 090. For example a rate of 10 mills would mean that 10 in tax is levied for every 1000 assessed value. Web The median property tax in Davidson County Tennessee is 1587 per year for a home worth the median value of 164700.

The exact property tax levied depends on the county in Colorado the property is located in. Web Minnesota is ranked 21st of the 50 states for property taxes as a percentage of median income. Web The millage rate would be the amount of tax assessed for each 1000 of property value.

Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties in order of. All Official Records and associated images from 1983 to present can be accessed through our Official Records Search. Tax rates in the county are likewise relatively low.

Web Read County Legislatives and other boards committees and commissions agendas and minutes. Harris Countys 3356 median annual property tax payment and 165300 median home value are actually not that far off the statewide marks. While the exact property tax rate you will pay for your properties is set by the.

Web Fairfield County Property Records are real estate documents that contain information related to real property in Fairfield County Connecticut. Web Even so the average effective property tax rate in Suffolk County is 237 far above both state and national averages. Web The median property tax in Montgomery County Pennsylvania is 3834 per year for a home worth the median value of 297200.

Montgomery County has one of the highest median property taxes in the United States and is ranked 76th of the 3143. Missouris median income is 56517 per year so the median yearly property tax paid by. Carver County collects the highest property tax in Minnesota levying an average of 104 of median home value yearly in property taxes while Koochiching.

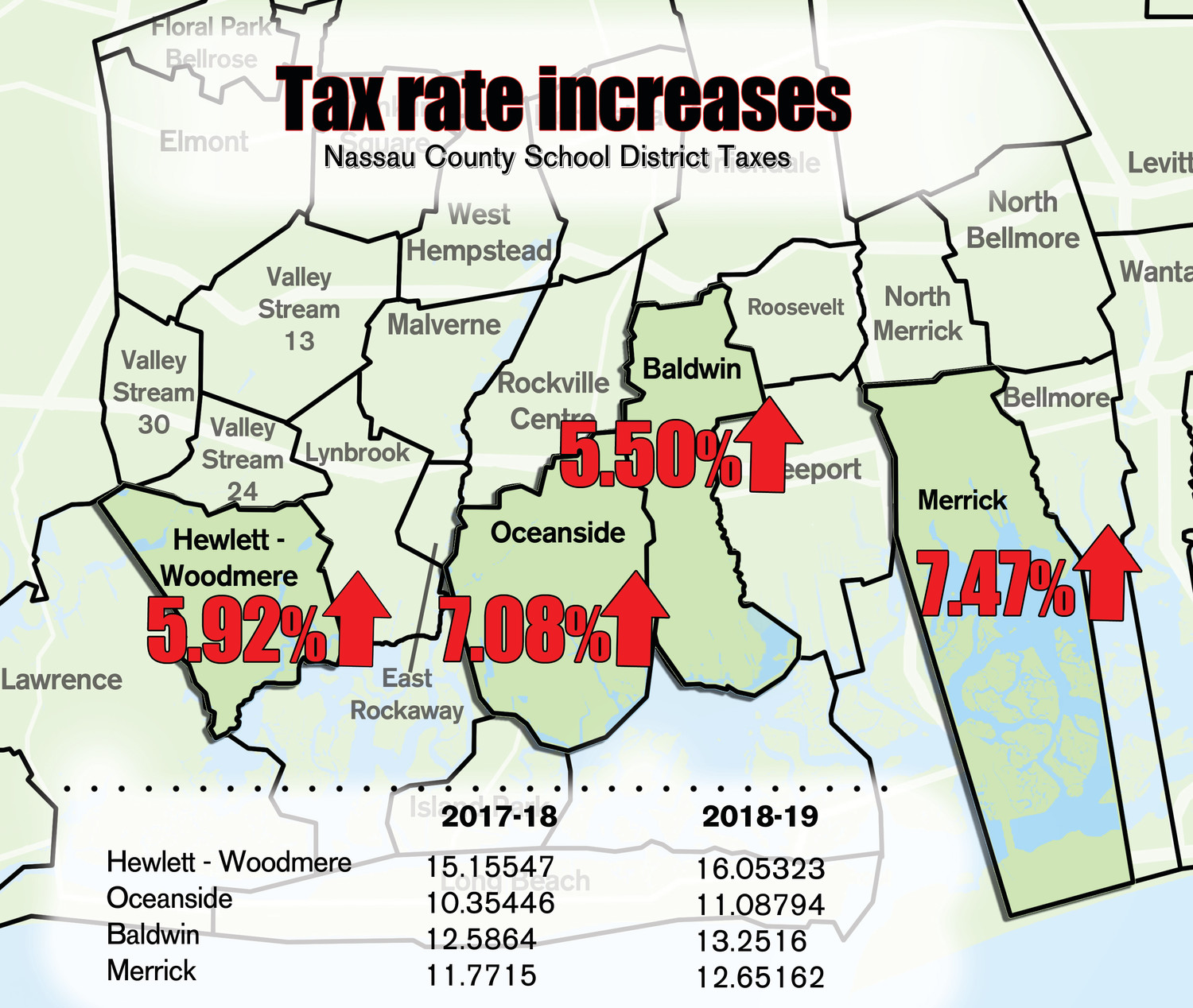

This guide will help you understand the purpose of property tax exemptions and show you how to lower. 8 voters in Nassau County have to decide whether they want to add 1 mill to their property tax rate. Nassau County property tax rate is one of the highest in New York state but if you are 65 or older you may be eligible for a Nassau County senior citizen property exemption.

The typical Westchester County homeowner pays. Fort Bend County has one of the highest median property taxes in the United States and is ranked 57th of the 3143. Missouri has one of the lowest median property tax rates in the United States with only fifteen states collecting a lower median property tax than Missouri.

If you need to discuss these amounts contact the Property Appraisers office or visit their website Nassau County Property Appraiser. Thats less than the state average and much less than the national average. Applications Licenses Forms and Permits.

The exact property tax levied depends on the county in Minnesota the property is located in. Web The median property tax in Fort Bend County Texas is 4260 per year for a home worth the median value of 171500. Nassau County Property Appraiser.

Web Through Nov. Multnomah County collects on average 099 of a propertys assessed fair market value as property tax. Birth Certificates Other Records.

Davidson County collects on average 096 of a propertys assessed fair market value as property tax. Web Nassau County Senior Citizen Property ExemptionA Complete Guide. Web The Recording Department is in charge of recording all court judgments liens marriage licenses mortgages plats and tax deeds for the Nassau County Book of Official Records.

It works out to 1 of extra taxes for every 1000 of property value. Lake County collects the highest property tax in Illinois levying an average of 219 of median home value yearly in property taxes while Hardin County has. Web The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700.

Web Colorado is ranked 36th of the 50 states for property taxes as a percentage of median income. For example a rate of 10 mills would mean that 10 in tax is levied for every 1000 assessed value. Web The median property tax in Missouri is 091 of a propertys assesed fair market value as property tax per year.

Web Additionally the Nassau County Civil Service Examination Announcements webpage includes a link entitled Job Descriptions and Job Interest Cards which offers the opportunity to view class specifications and fill out a form so that you may receive an email notification when an open competitive examination for a particular title is announced in. Web The median property tax in Multnomah County Oregon is 2774 per year for a home worth the median value of 281600. Web The millage rate would be the amount of tax assessed for each 1000 of property value.

Web Yet at 089 Florida is slightly below the national average property tax rate of 111 and Texas is seventh highest in property tax rates at 18. The exemption is applied to all taxes including the school district taxes. Davidson County has one of the highest median property taxes in the United States and is ranked 705th of the 3143.

Montgomery County collects on average 129 of a propertys assessed fair market value as property tax. What does it mean when a house is a homestead. Within the county for tax purposes.

Fort Bend County collects on average 248 of a propertys assessed fair market value as property tax. Web Homeowners in Pinellas County pay a median property tax of 1642 per year. Multnomah County has one of the highest median property taxes in the United States and is ranked 203rd of the 3143.

Meanwhile California is 16th lowest in property tax rates at 076. Ventura County collects on average 059 of a propertys assessed fair market value as property tax. It appears they are fleeing California because of the highest income tax rate in the country.

Web A MESSAGE FROM QUALCOMM Every great tech product that you rely on each day from the smartphone in your pocket to your music streaming service and navigational system in the car shares one important thing. The Commissioners Court sets the Harris County property tax rates. In dollar terms Westchester County has some of the highest property taxes not only in the state of New York but in the entire country.

Web Illinois is ranked 5th of the 50 states for property taxes as a percentage of median income. The exact property tax levied depends on the county in Illinois the property is located in. Web The median property tax payment in Texas is 3390 and the median home value is 200400.

Your actual property tax burden will depend on the details and features of each individual property.

Sales Tax Rates Additional Sales Taxes And Fees

Legislature Votes To Expand Tax Exemptions Herald Community Newspapers Www Liherald Com

Nassau County Property Tax Reduction Tax Grievance Long Island

Where Do Homeowners Pay The Most In Property Taxes The Washington Post

News Flash Nassau County Ny Civicengage

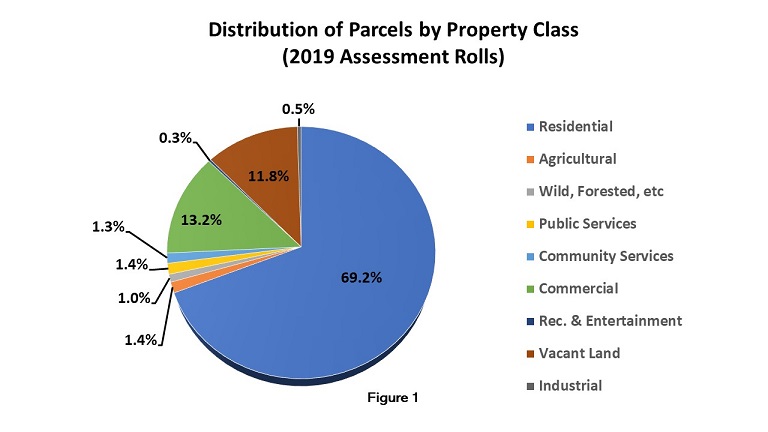

Distribution Of Parcels By Property Class Code 2019 Assessment Rolls

State Tax Treatment Of Homestead And Non Homestead Residential Property

New York S Broken Property Assessment Regime City Journal

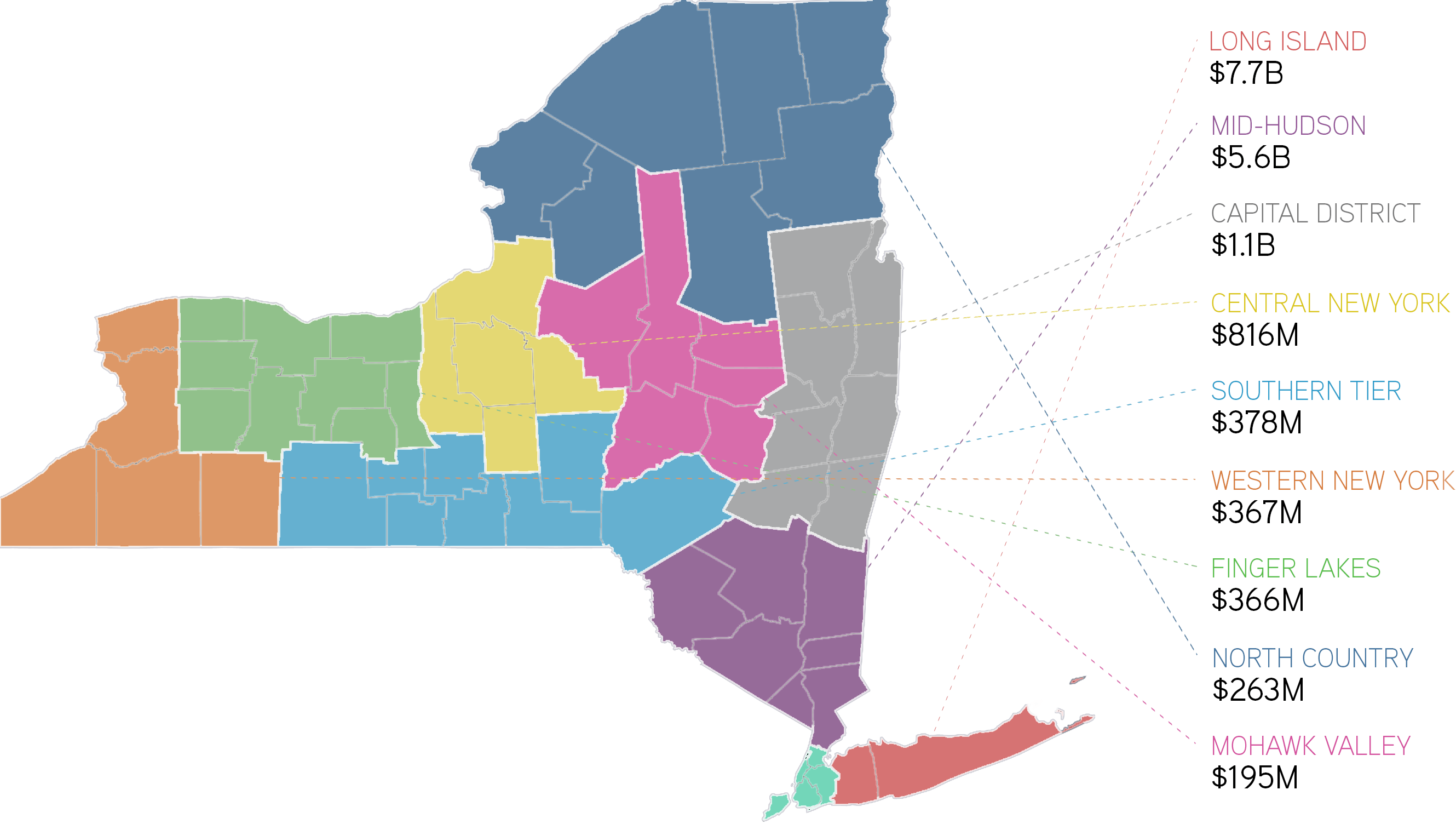

By The Numbers Regional School Property Tax Growth Under The Tax Cap Rockefeller Institute Of Government

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Which Local Community Pays The Highest Taxes It Might Surprise You

Nassau County Tax Rate Hike Despite Property Values Zooming Amelia Island Living

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Nassau County Property Tax Grievance Realty Tax Challenge

District Asking Nassau County Voters To Approve Property Tax Increase Aimed At Improving Schools

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates